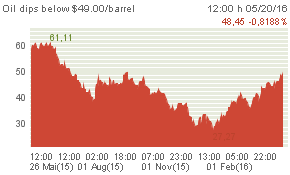

Oil dips below $49.00 mark on profit-taking

After tapping $50.00/barrel mark on Thursday for the first time since Oct. 2015, WTI crude oil future failed to retain its strength above the psychological mark and the rally fizzled, dragging the commodity lower.

Oil extended its slide on Friday and has now dipped below $49.00 handle as the greenback ticked higher ahead of the US GDP data and as traders seems to take some profit off the table at higher level. Traders seem to turn cautious at higher levels on speculation of a June Fed rate-hike, which would boost the greenback and drag dollar-denominated commodities lower.

Market players now look forward to the OPEC meeting scheduled for June 2, where most analysts are not expecting produces to reach to any sort of agreement on output freeze. Some analysts also expect that the recent supply disruptions might be temporary and the persisting supply glut might put the ongoing bullish momentum at risk.

Technical levels to watch

On the immediate downside, weakness below $48.75-70 immediate support is likely to get extended towards $48.00 round figure mark. Break below $48.00 is likely to trigger additional downward pressure, dragging the commodity towards an important resistance break-point turned strong support near $47.00 handle.

On the flip side, recent …read more

Source:: FX Street