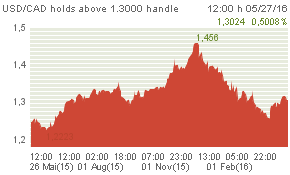

USD/CAD inches higher to 1.3040 as oil slides further

As oil retreat from the much talked above $50.00 psychological mark, the USD/CAD pair extended its Thursday’s bounce off 50-day SMA support to currently trade comfortably above 1.3000 handle at 1.3040.

Extending its decline from $50.00/barrel mark, crude oil has now dropped below $49.00 level. A high degree of correlation with oil prices kept the Canadian Dollar (CAD) on back foot against its US counterpart, lifting the USD/CAD pair back above 1.3000 handle.

On Thursday, the USD/CAD pair staged recovery from an important confluence support near 1.2915, comprising of 50 & 20-day SMAs and 38.2% Fibonacci retracement level of 1.2461-1.3188 recent up-move. As the US Dollar continues to gain traction on Friday, ahead of the first revision of the first quarter GDP growth, the pair touched session high level of 1.3048. A follow through buying interest beyond 1.3050 would open room for further appreciation for the pair.

Technical levels to watch

On a sustained up-move beyond 1.3050 level, the pair seems all set to dart towards 1.3090-1.3100 handle resistance, beyond which the up-move could get extended towards recent daily closing highs resistance near 1.3140-45 zone.

On the flip side, failure to conquer its immediate resistance and a subsequent drop back below 1.3000 handle is …read more

Source:: FX Street